This guide provides a comprehensive analysis of Nintendo's (NTDOY) stock dividend, offering actionable insights for various investor profiles. We will examine its dividend history, financial health, inherent risks, and provide tailored recommendations for individual, institutional, and financial analysts.

Dividend History Analysis: A Tale of Two Payouts

Nintendo's dividend history reveals a pattern of semi-annual payments. However, a significant year-over-year decline—approximately 28% from 2023 to 2024, according to some reports—needs examination. This inconsistency warrants careful scrutiny. Why the decrease? Is it a temporary blip, or a more concerning trend reflecting the company's financial position? Understanding this requires a thorough review of their financial statements.

One challenge in analyzing this data is the inconsistency across different sources. Some reports adjust for stock splits, while others do not, leading to variances in reported dividend yields (ranging from 0% to 0.95% in our research). This highlights the importance of relying on official Nintendo financial statements for accurate, reliable information. A detailed chart comparing dividend payouts across years, adjusted for inconsistencies, is crucial for a complete understanding. [A detailed chart should be inserted here, sourced from official Nintendo financial statements, comparing year-over-year dividend payouts and accounting for any stock splits].

Financial Deep Dive: Assessing Dividend Sustainability

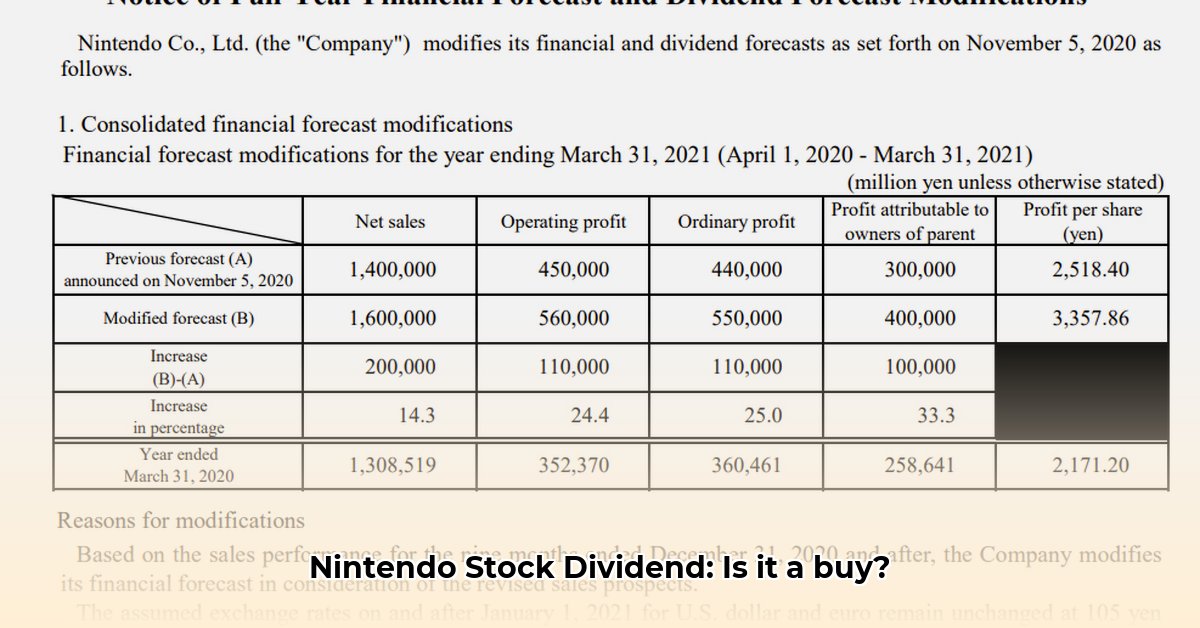

Analyzing Nintendo's dividend sustainability requires examining key financial metrics. The payout ratio—the percentage of earnings distributed as dividends—is paramount. A high payout ratio can indicate a less stable dividend, as it leaves fewer resources for reinvestment, unforeseen expenses, and future growth. Unfortunately, readily accessible, consistently reported payout ratio data for Nintendo is limited. This necessitates calculation using publicly available information from their income statements and balance sheets. The resulting calculations, clearly presented, are vital for a reliable assessment.

To conduct your own analysis, you will need to calculate the payout ratio using the formula: (Total Dividends Paid / Net Income) * 100%. This requires careful examination of Nintendo's financial reports. Remember to consider factors like earnings per share (EPS) and free cash flow (FCF), which are directly linked to dividend sustainability.

Is Nintendo generating sufficient profit to comfortably maintain current dividend payments? Are they adequately preserving cash reserves for future payouts? Answering these questions requires a thorough review of their financial statements. A detailed analysis of these key metrics is essential for understanding the long-term sustainability of Nintendo's dividends.

Risk Assessment: Understanding the Potential Pitfalls

Investing in Nintendo's dividends, like any investment, carries inherent risks. Our risk assessment matrix highlights potential challenges and mitigation strategies:

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Unsustainable Dividend Policy | High | High | Diversify investments; closely monitor financial statements. |

| Inconsistent Financial Reporting | Medium | Medium | Cross-reference data; seek clarification from Nintendo. |

| Macroeconomic Uncertainty | Medium | Medium | Evaluate broader market trends; develop investment contingencies. |

| Geopolitical Instability | Low | High | Diversify internationally; monitor global events closely. |

Actionable Steps for Investors: Tailored Strategies

Investment strategies should align with individual objectives and risk tolerance. Here are tailored recommendations:

1. Individual Investors:

- Short-Term (0-1 year): Exercise caution. Diversify your portfolio. Monitor Nintendo's financial news closely. Dividend cuts are possible.

- Long-Term (3-5 years): Thoroughly research Nintendo's long-term financial projections and plans. Assess their long-term dividend policy. Re-evaluate periodically.

2. Institutional Investors:

- Short-Term: Analyze the impact of reduced dividends on overall investment strategies. Engage with Nintendo's management for clarifications.

- Long-Term: Advocate for improved transparency in dividend reporting. Develop comprehensive financial models incorporating various economic scenarios.

3. Financial Analysts:

- Short-Term: Investigate data inconsistencies across reporting sources. Analyze Nintendo's recent financial performance to understand dividend cuts.

- Long-Term: Forecast future dividends, considering macroeconomic factors and potential changes in Nintendo's business strategy. Explore the correlation between game sales and dividend decisions.

Conclusion: Due Diligence is Key

Nintendo's dividend history displays fluctuating payouts. A thorough analysis of their financial health and a considered assessment of the inherent risks are crucial. Remember to diversify investments, and actively monitor Nintendo’s financial reports and investor communications. Consult a qualified financial advisor for personalized advice before making any investment decisions. Continuous monitoring and independent research are essential for informed investing.